Hoa Binh Construction (HBC): A partner agrees to buy 5 million shares at the price of 32,000 VND/share, the total awarded tender value in 4 months reaching 9,300 billion VND

news

In order to supplement business capital and realize strategic goals, the Board of Directors of the Company approved a plan to issue 74 million shares privately.

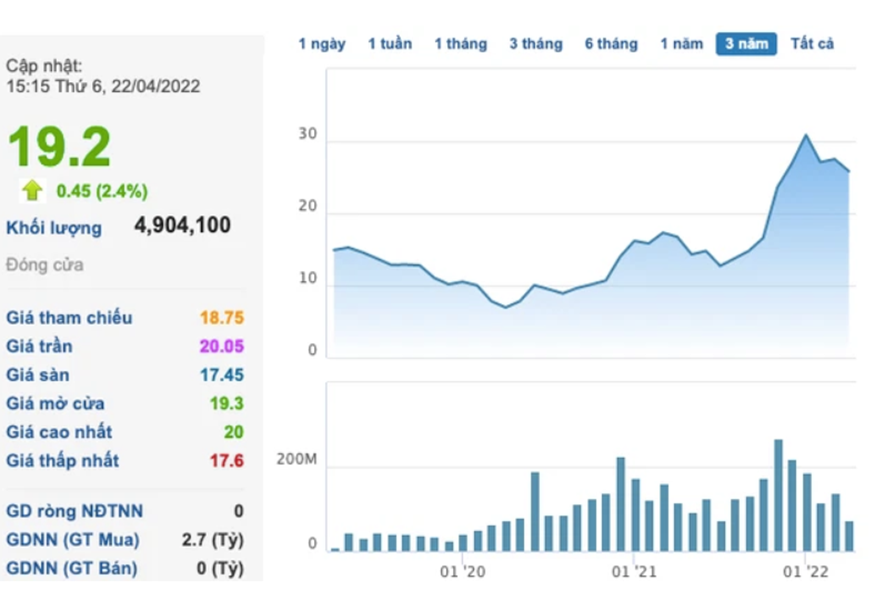

The stock market situation has not been positive, with a flood of negative information leading to a series of corporate stocks falling sharply. Consequently, Hoa Binh Construction (HBC) shares experiences 4 instances of hitting the floor price, partly affecting the psychology of shareholders approaching the date of the General Meeting of Shareholders.

In a recent announcement, HBC reports that the business situation is still stable, and the company has completed procedures to organize a shareholder report at the upcoming Annual General Meeting. In 2021, HBC won many large bidding packages with a total winning value of VND 16,471 billion, 18% higher than the set plan.

Statistics from the beginning of the year until now shows the company continues to be contracted by strategic partners and major investors. As of mid-April 2022, the total winning tender value is 9,300 billion VND out of the 2022 plan of 20,000 billion VND. The company ensures all projects under construction are always done with safety, progress and quality together with the investor to overcome the general difficult period of the construction real estate industry.

According to the 2022-2032 strategy, HBC aims to expand to foreign markets, maintaining a 5-year revenue growth rate increasing 5 times by 2032, with revenue approximately 20 billion USD and profit nearly 1 billion USD.

Regarding debts owed by FLC Group, HBC has recovered FLC's debts up to now, which is 220 billion dong out of total receivables of 285 billion dong. The final payment deadline is the end of April 2022. In case FLC fails to comply with the payment schedule, HBC will request the Judgment Enforcement Agency to execute the judgment in accordance with the law.

In order to supplement business capital and realize strategic goals, the Board of Directors of the Company approved a plan to issue 74 million shares privately.

"We have reached an official agreement with a partner to buy 5 million shares at the price of 32,500 VND/share, they are one of the top 10 Japanese real estate investors with the holding term as prescribed by the securities law, they see the growth potential of HBC and are considering buying more shares.

Furthermore, we are still negotiating a number of other interested investors. Hopefully the stock market will stabilize again, the company's probability of success in issuing shares is very high," emphasized Chairman Le Viet Hai.

Tri Tuc

Vietnam Economic Times

Tin liên quan

Hòa Bình đạt môi trường làm việc...

Anphabe vừa công bố Tập đoàn Xây dựng Hòa Bình đạt danh hiệu số 1 về môi trường làm việc...

Mang nụ cười đến cho 1.000 trẻ ở Trà...

Ngày 25-8, khoảng 1.000 bé trong độ tuổi từ 6 đến 10 tại Trà Vinh đã được khám, chữa răng...

Giấc mơ siêu dự án của 'ông trùm' xây...

Cuộc "so găng" của hai ông lớn trên thị trường xây dựng là Hòa Bình và Coteccons được ví như...